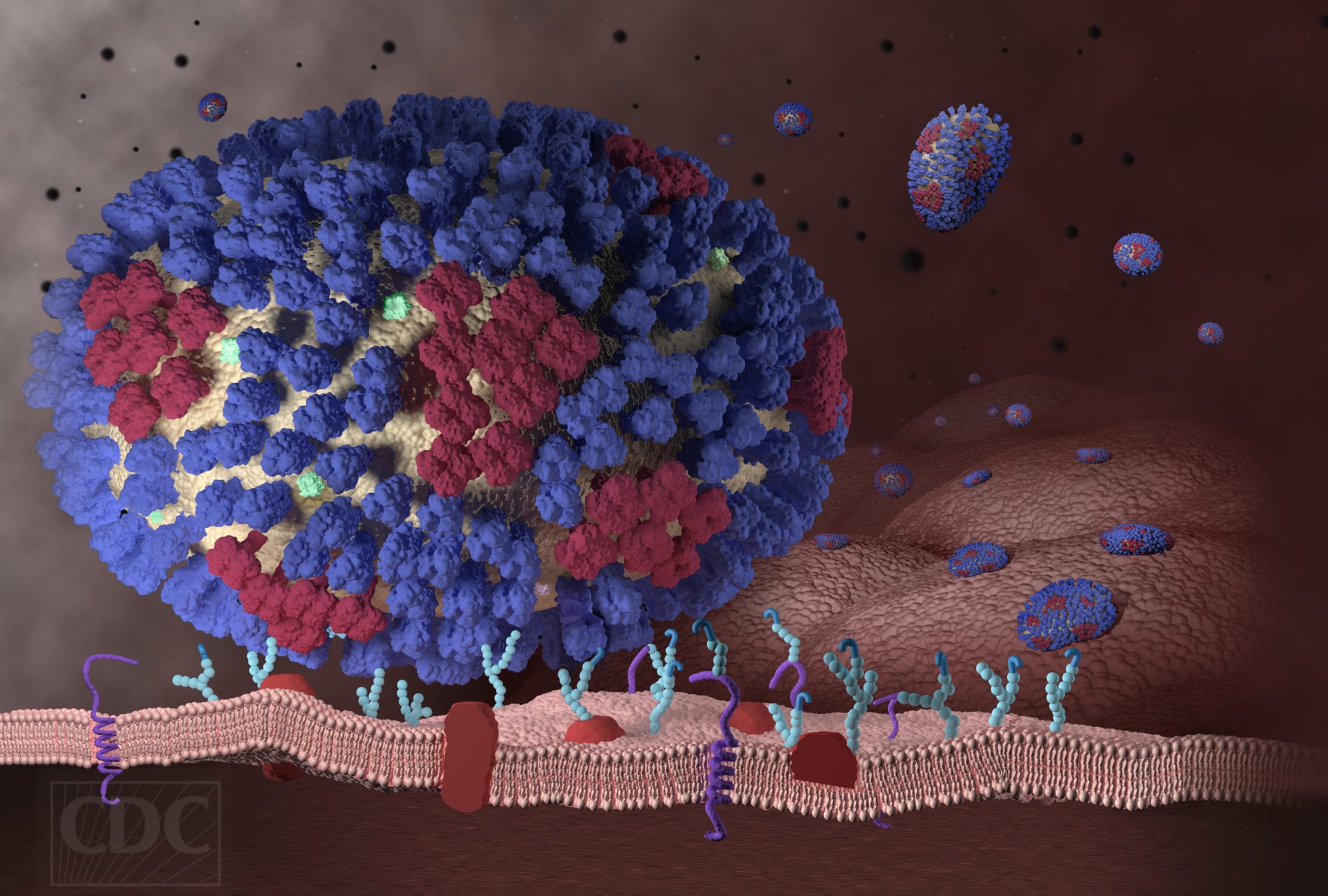

The flu virus (CDC)

Roche tacks on another Xofluza indication as flu season meets pandemic

Xofluza was heralded as the first new flu drug in 20 years when it got the FDA OK back in 2018. But even so …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.