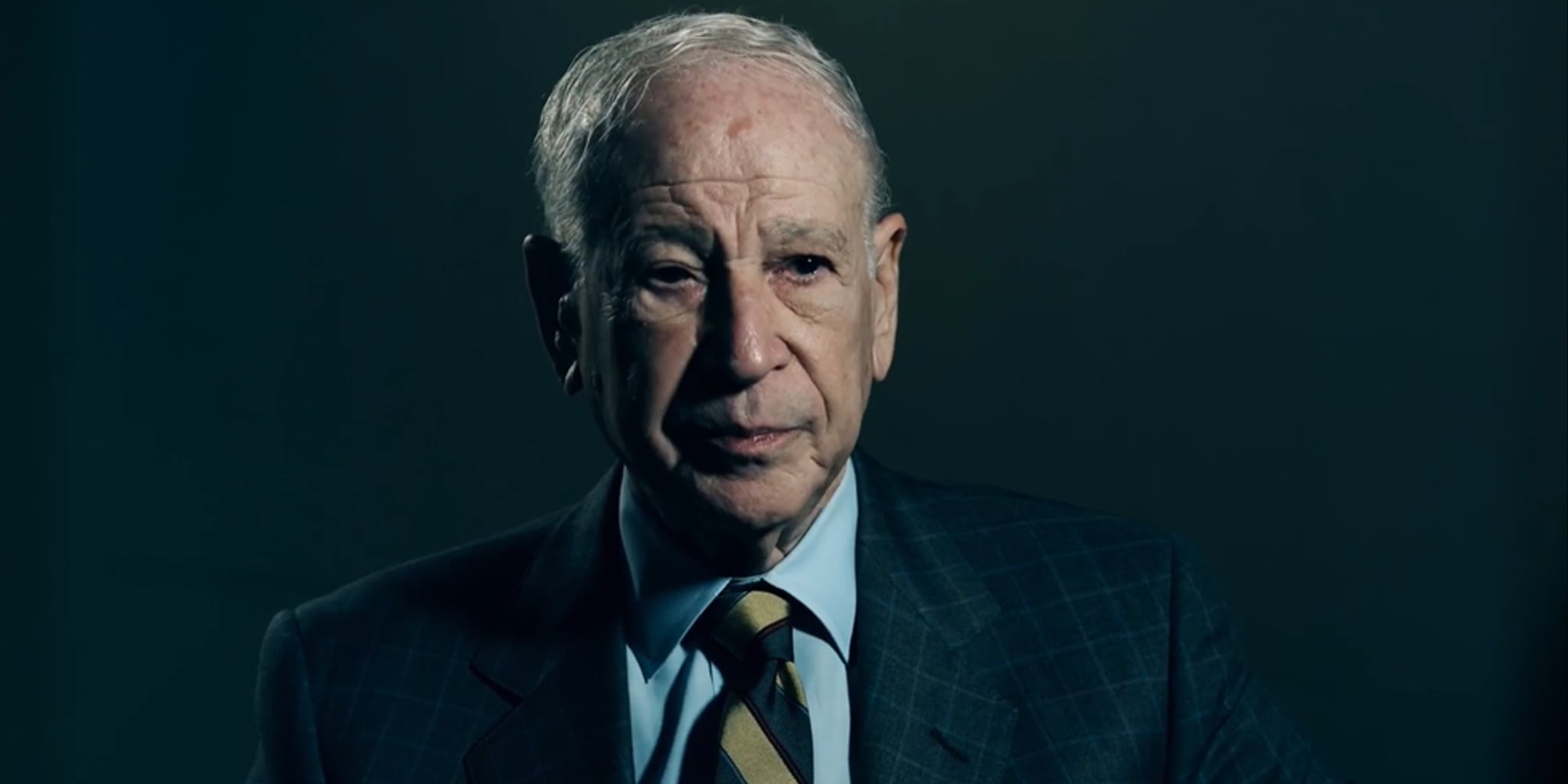

SEC accuses biotech billionaire Phillip Frost of joining a 'pump-and-dump' scheme that netted $27M

Over the years Phillip Frost has acquired quite a reputation in biotech. He chaired Teva, manages Opko Health — and now has to contend with accusations from the SEC that he actively participated in a scheme to pump up biotech share prices in order to reap millions in windfall profits ahead of their collapse.

According to the SEC, Barry Honig led an effort to pump up the share prices of three companies — identified by the Wall Street Journal as BioZone Pharmaceuticals, MGT Capital Investments and MabVax — paying for articles in Seeking Alpha that touted their potential. Frost, says the SEC, participated in two out of the three pump-and-dumps.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.