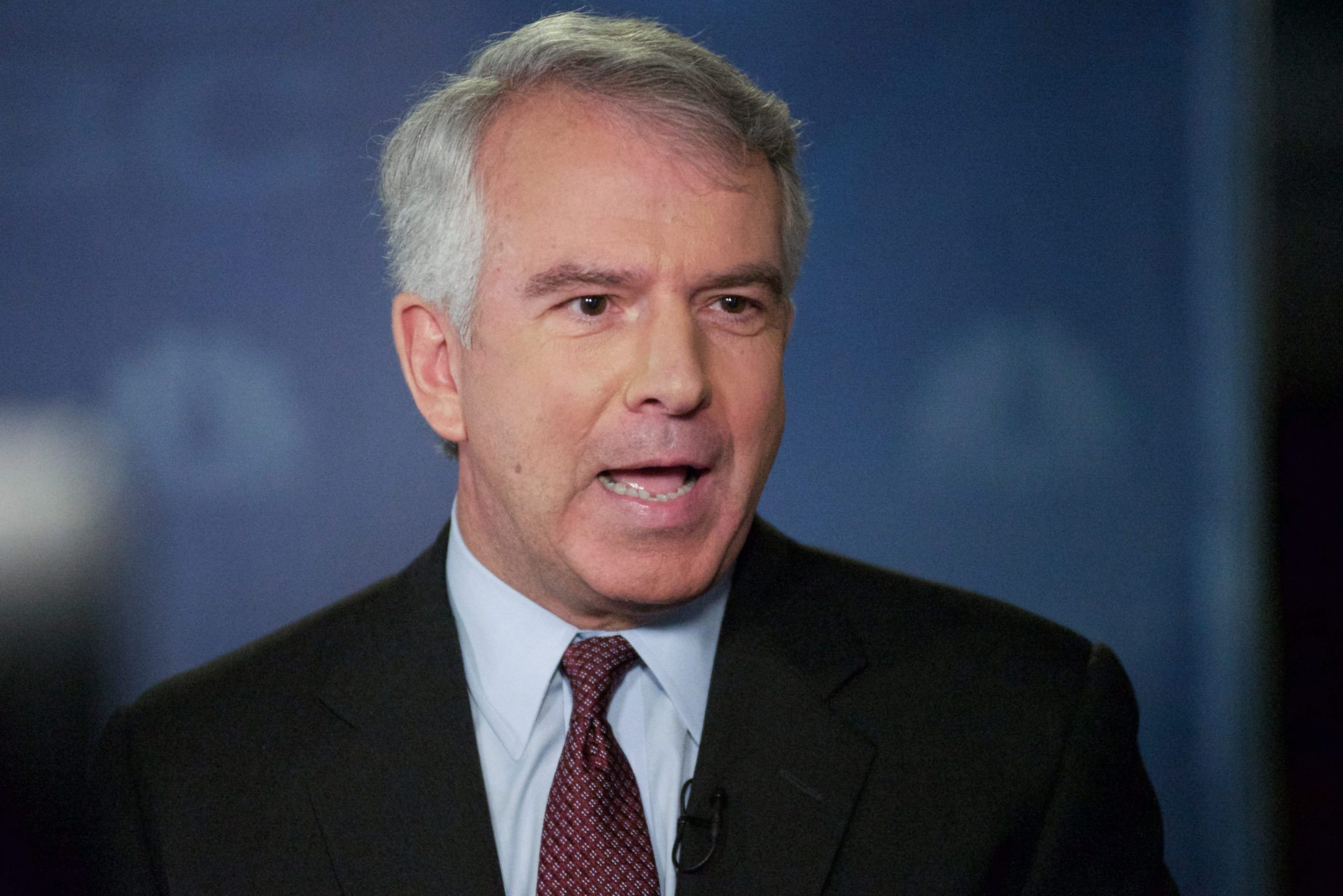

Taking on a big challenge, ex-Celgene CEO Bob Hugin readies a run for the Senate

Can a highly successful biopharma executive and ex-Marine win a Senate race for the Republicans in New Jersey?

Ex-Celgene CEO — and until a few days ago executive chairman — Bob Hugin intends to find that out.

For years Hugin impressed Wall Street with his record of big annual revenue gains and a blizzard of partnership deals around the world for his biotech. That earned Celgene a market cap of $72 billion.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.