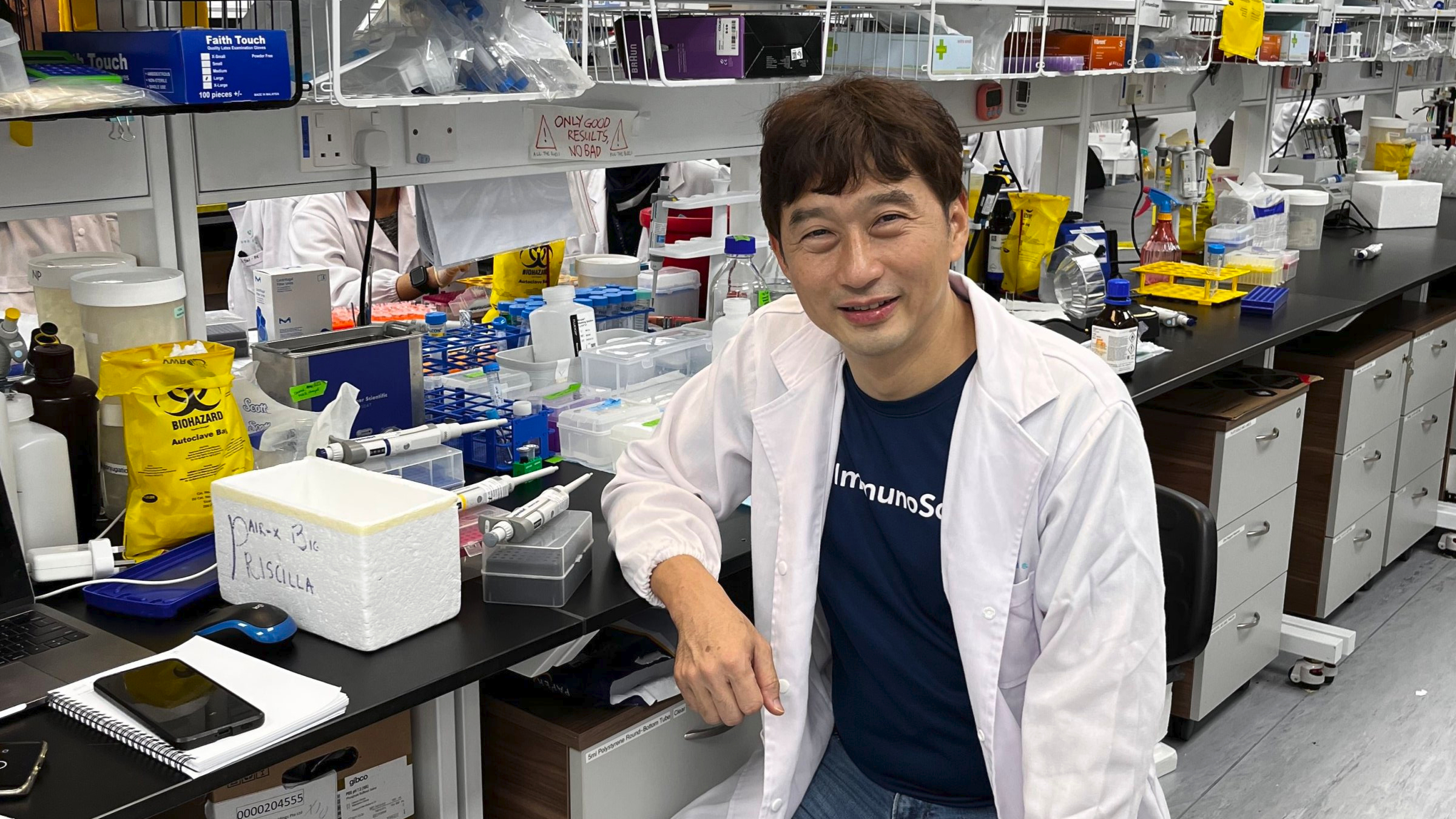

Choon-Peng Ng, ImmunoScape CEO

TCR upstart gets fresh funding as it looks to charge toward the clinic

While several companies have been finding success in the TCR-T cell therapy space — with Intellia having its treatment accepted by the FDA last year …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.