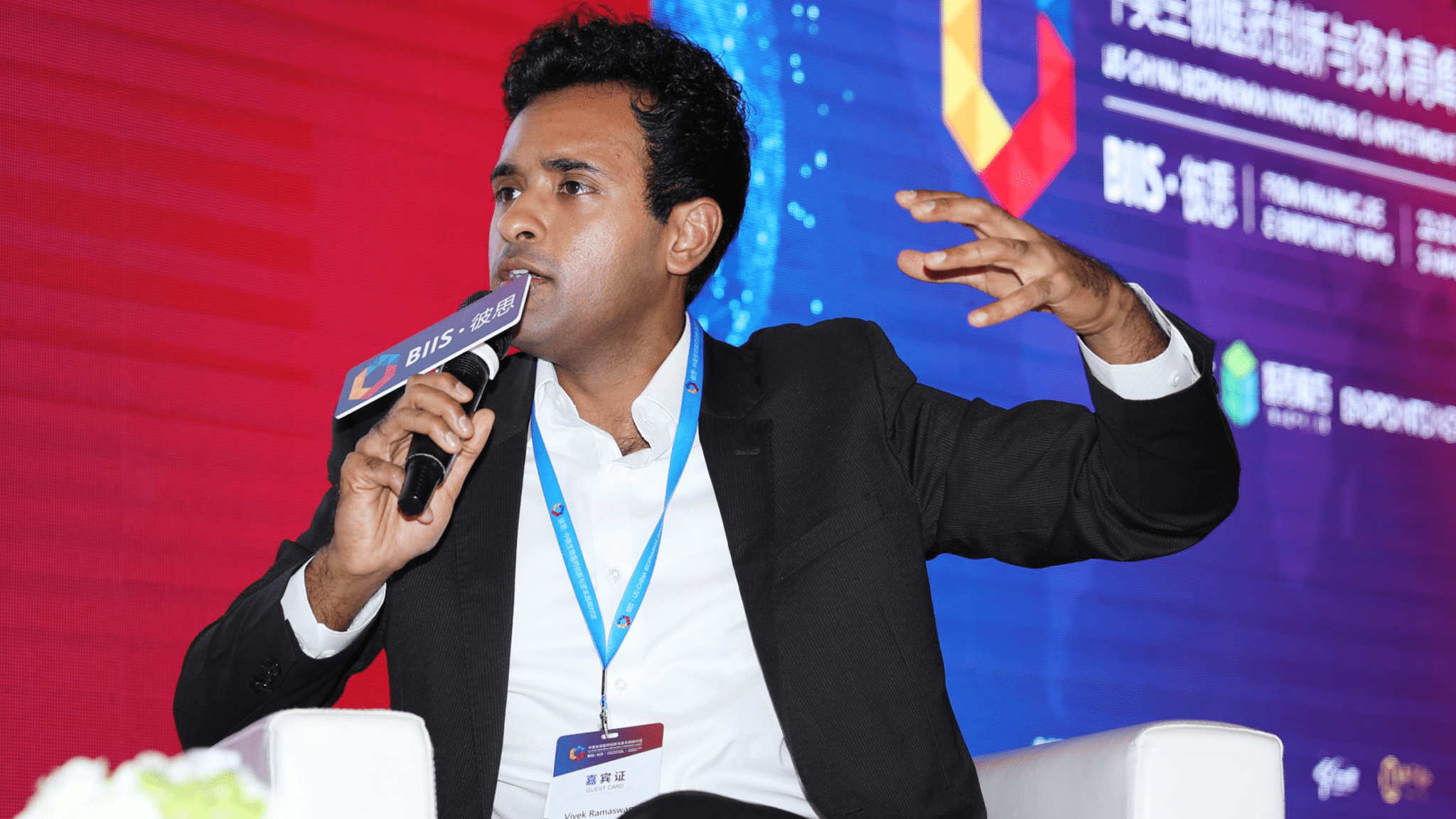

Vivek Ramaswamy’s Urovant claims a big win in PhIII — but questions linger about a cheap generic and their branded rival

After the great Axovant implosion that swept away its highly touted Alzheimer’s drug, Roivant chief Vivek Ramaswamy needed one of the biotechs in his …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.