Women are gaining more board seats in biotech, but real change is happening at a snail's pace

Source: Liftstream

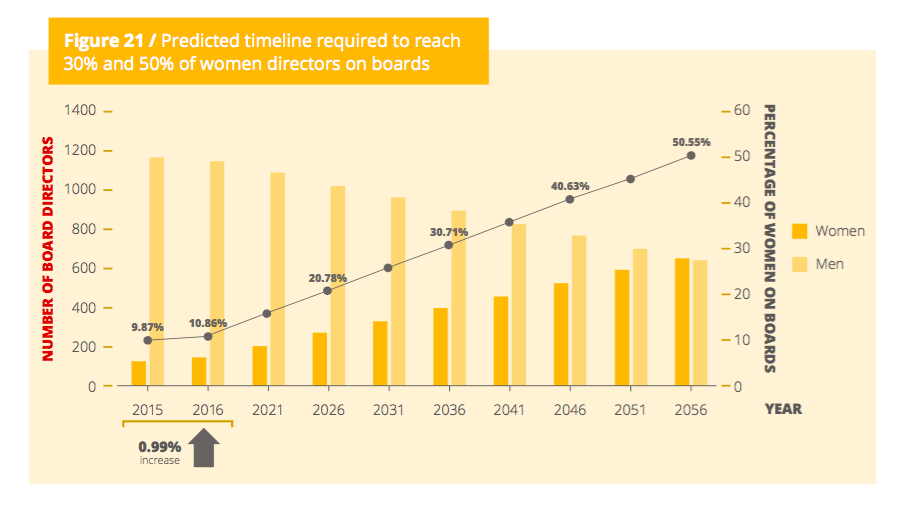

The number of women occupying board seats at 177 biotech companies that went public between 2012 and 2015 ticked up last year. But just barely, with one in 10 board seats occupied by a woman. And a new study examining the progress of seeing more women on biotech boards concludes that we can meet gender parity at this rate — but it won’t arrive until 2056.

The study comes from Karl Simpson, CEO of Liftstream, an executive search firm. Simpson made waves back in 2014 when he first highlighted just how rare it is for a woman to reach the top job in biotech. In this new look, he examined the reasons for what is still near glacial movement on this front, which comes a year after some controversial parties at JP Morgan helped bring the issue of gender diversity to the forefront.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.