Pharma's broken business model: An industry on the brink of terminal decline

Biotech Voices is a collection of exclusive opinion editorials from some of the leading voices in biopharma on the biggest industry questions today. Think you have a voice that should be heard? Reach out to Amber Tong.

Biotech Voices is a contributed article from select Endpoints News readers. Commentator Kelvin Stott regularly blogs about the ROI in pharma. You can read more from him here.

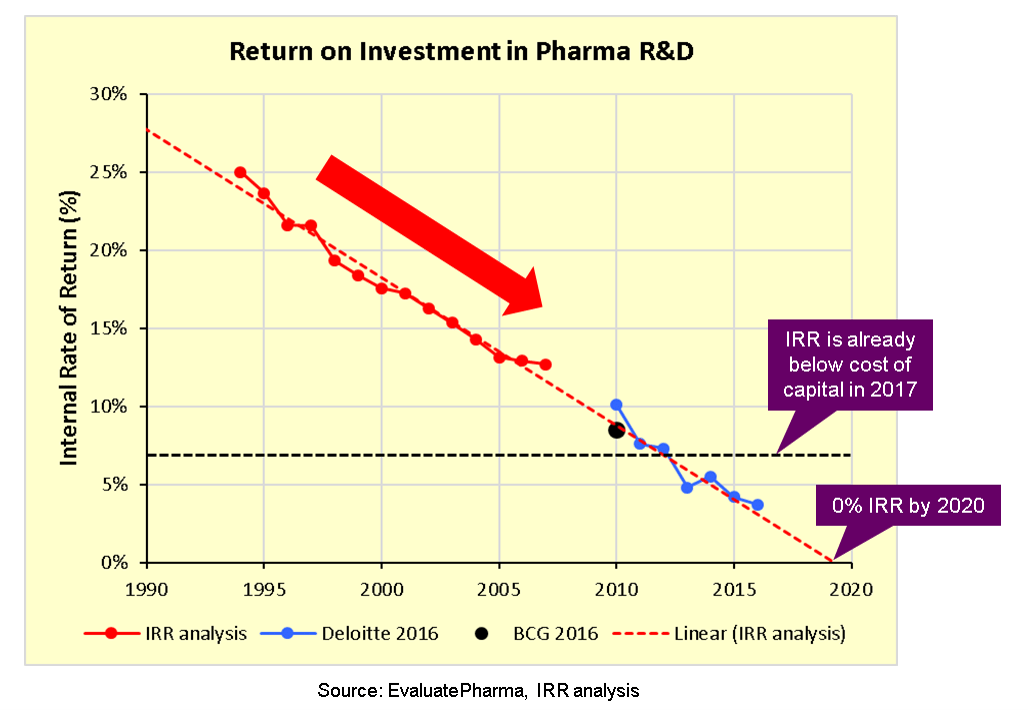

Like many industries, pharma’s business model fundamentally depends on productive innovation to create value by delivering greater customer benefits. Further, sustainable growth and value creation depend on steady R&D productivity with a positive ROI in order to drive future revenues that can be reinvested back into R&D. In recent years, however, it has become clear that pharma has a serious problem with declining R&D productivity.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.