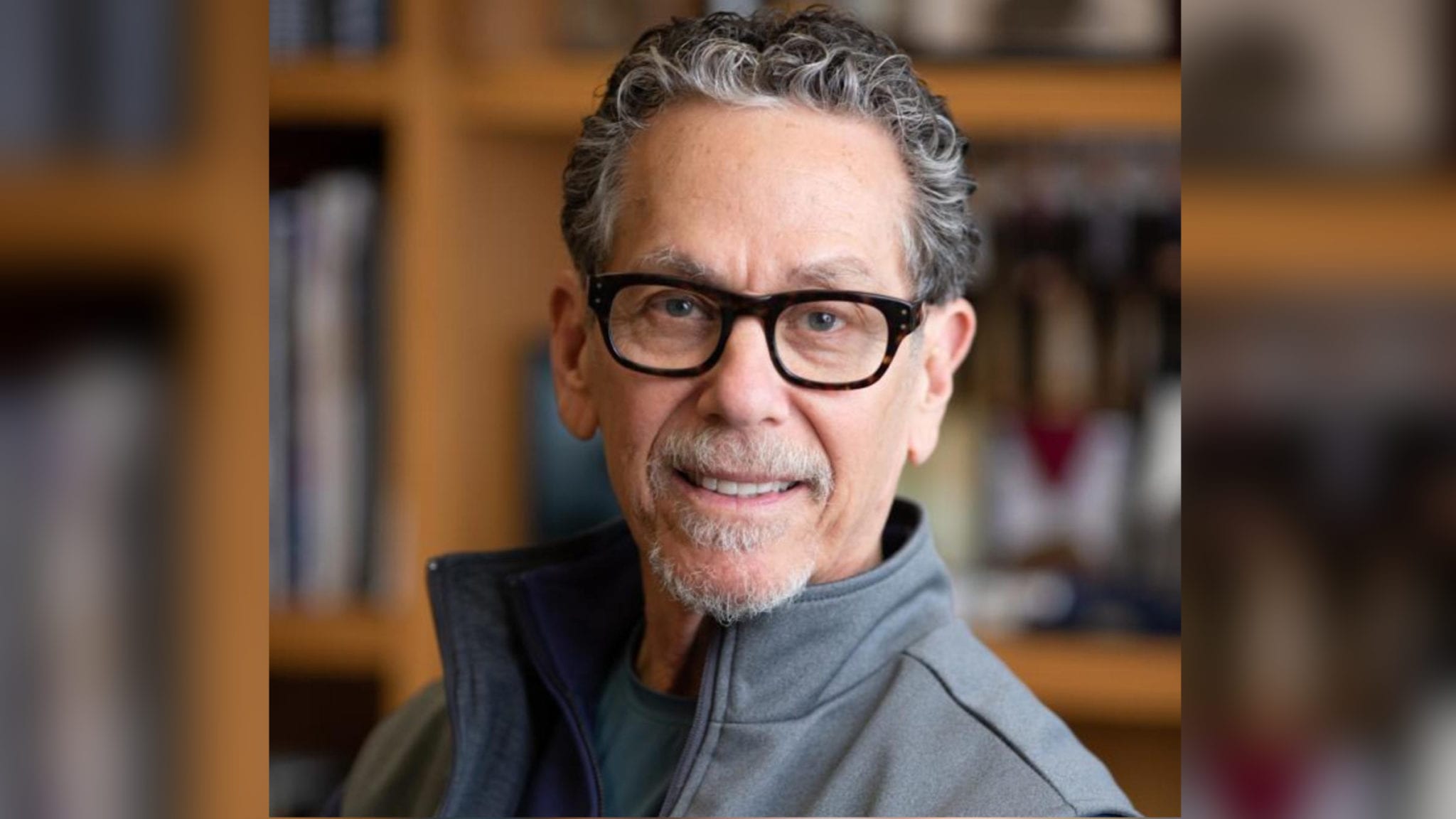

Ron Evans steals a trick from I/O, and points the way to a transformational diabetes therapy

Salk Institute scientist and serial biotech entrepreneur Ron Evans showed new mouse work yesterday that could point to a long-sought holy grail for diabetes treatment.

The study, published in Nature, involved a new approach for islet cell transplant, a diabetes therapy where dysfunctional insulin-producing cells on the pancreas are replaced with functional ones. The treatment has been around for a while and new ones are in development, but they’ve been hampered by the fact that patients will reject the cells unless they go on immuno-suppressive drugs.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.