Targeting the BFPs of the CNS, Biogen licenses map of genetic neighborhoods in the brain

Searching for new methods of attacking serious central nervous system diseases, Biogen has signed a deal that could be run into the hundreds of millions of dollars to essentially license a transcriptional map of the brain and scan it for new drug targets.

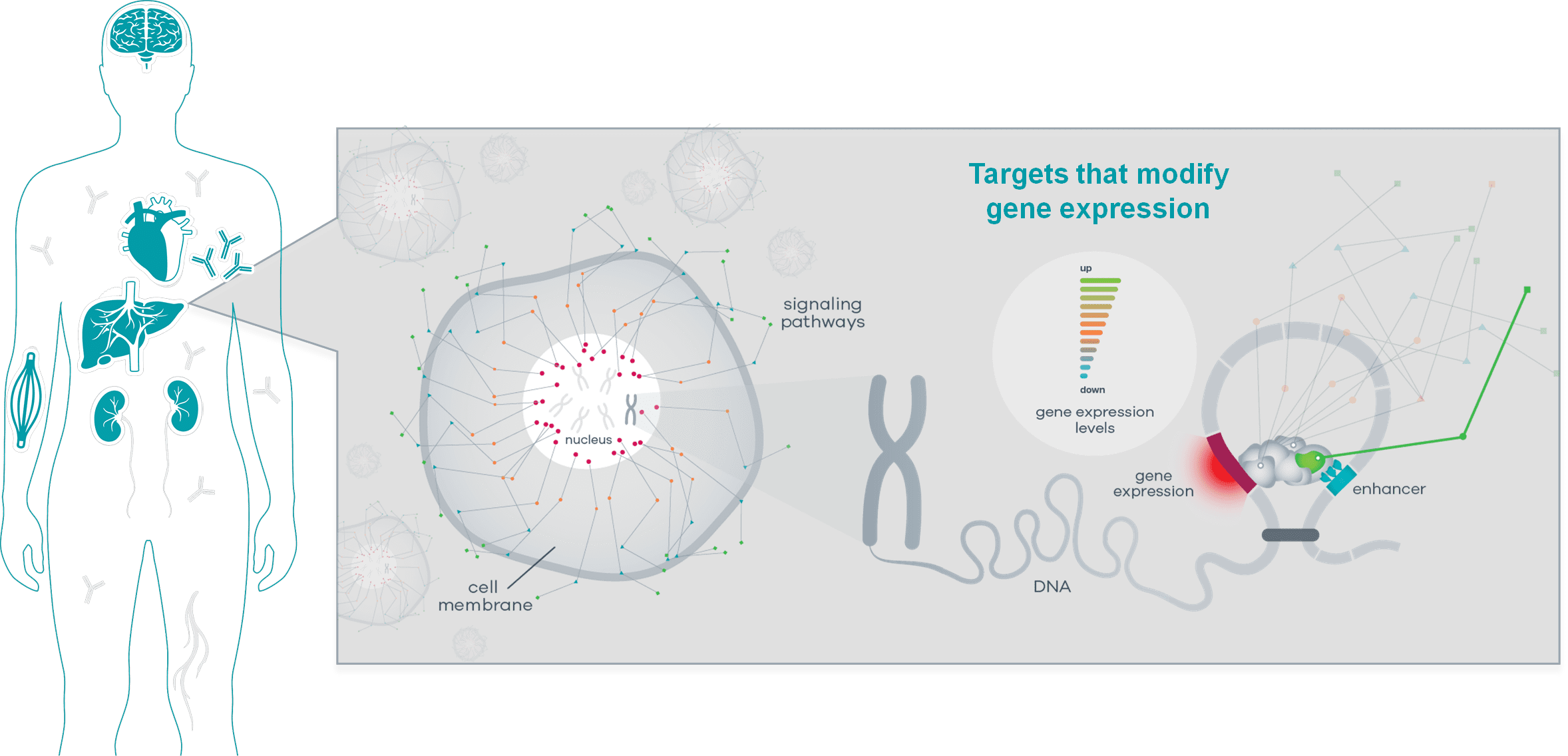

The partnership, worth $15 million upfront and far more in milestones, is with a new bioinformatics startup called CAMP4 Therapeutics. Founded in 2018 year by the Whitehead Institute’s Richard Young and Harvard Medical School’s Leonard Zon, CAMP4 takes genes considered affiliated with a disease and maps out the various ways cells express those genes and turn them on or off. They then take that map and – in the biological equivalent of stretching a war map across a table in a bunker — mark up all the different methods of attack.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.