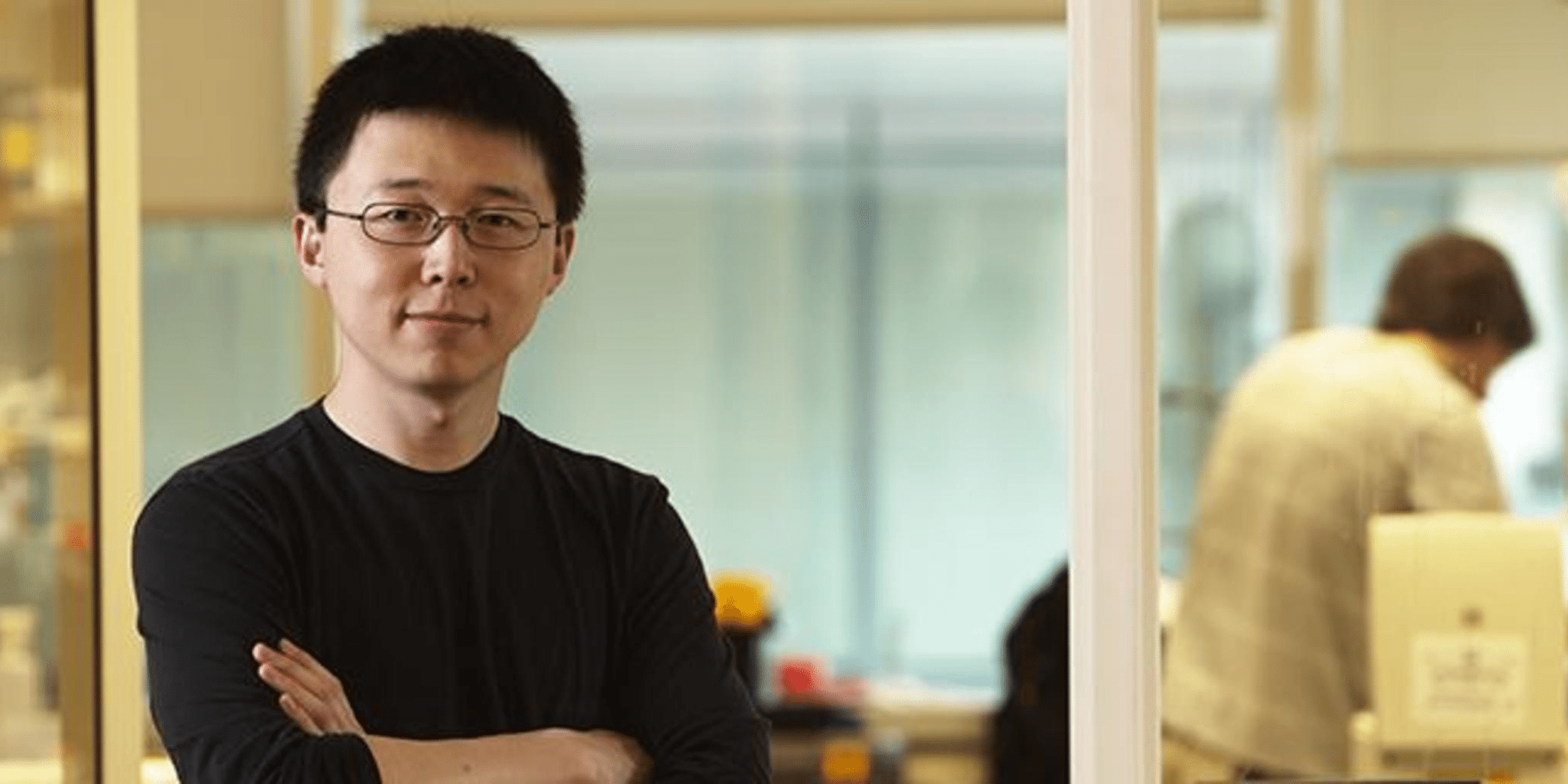

Broad star Feng Zhang unveils a new CRISPR platform, editing RNA and eliminating Alzheimer's threat — in cells

Broad Institute star scientist Feng Zhang is back in the spotlight, adapting CRISPR technology in a shift from permanently editing DNA to revising RNA — temporarily if needed. And he illustrated the promise of this approach by deactivating APOE4, which may be a ticking time bomb for people at risk of developing Alzheimer’s.

CRISPR/Cas9 gene editing tech has taken the lab by storm, in part because of the work Zhang and his one-time colleagues Jennifer Doudna and Emmanuelle Charpentier accomplished. They’re still scrapping over the patents to the original Cas9 work. But Zhang, who founded Beam Therapeutics with David Liu and Keith Joung, has moved on in search of better tech, and in a paper published in Science, says they have made real progress in switching from DNA to RNA editing.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.