The top 15 would-be blockbusters in the pipeline prepping for a 2017 launch

This is the year that a whole slate of Big Pharmas should be able to score bragging rights to blockbuster drug launches. And after last year’s paltry roundup of new drug approvals, they all desperately need it.

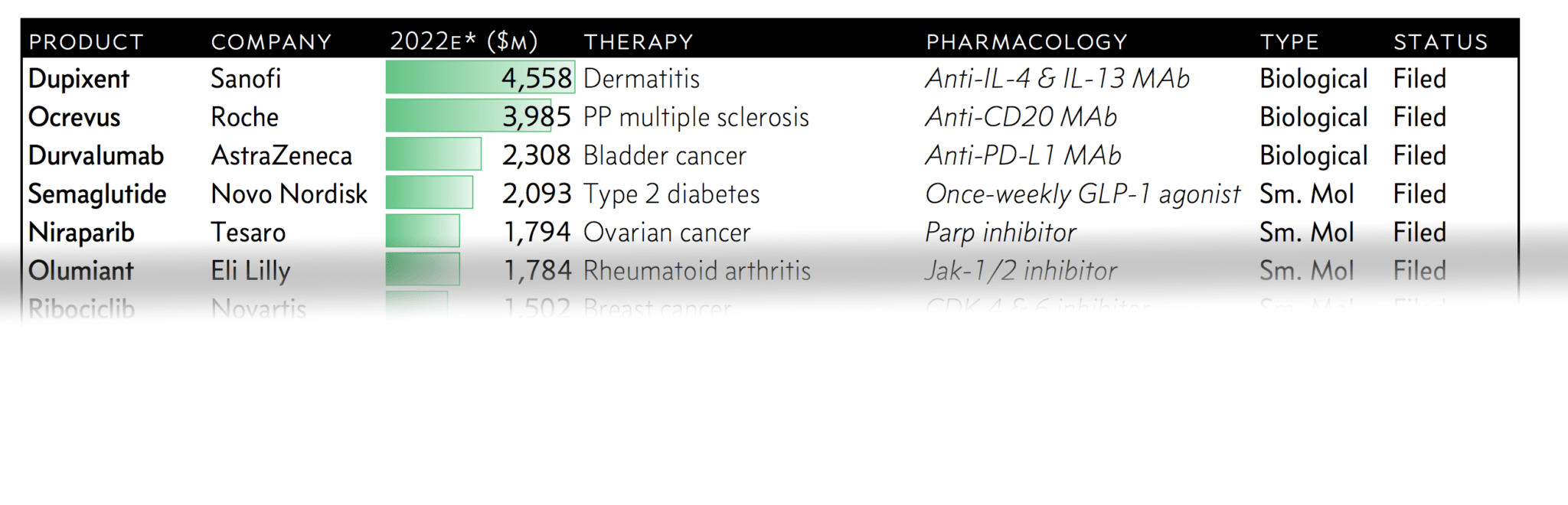

Every year Evaluate Pharma likes to do its breakdown of the top 20 small molecules and biologics aiming to hit the market, ranked by estimated 2022 sales. (Being a bit agnostic about this, we mashed the two lists into one and ranked them all by peak sales forecasts.)

There are 15 would-be blockbusters in Evaluate’s top 20. And this year’s list includes some notable standouts.

AstraZeneca has one drug on the list, its PD-L1 checkpoint inhibitor durvalumab, which is make or break for this pharma giant. The diversified J&J, which has three drugs on the blockbuster list, is looking to capitalize on some earlier dealmaking. Eli Lilly still has a point to make with baricitinib, hoping to show that it can consistently develop new blockbusters. Sanofi and Regeneron have some scores to settle with dupilumab. And even Roche is back with a potential megablockbuster to add — after a delay of game near the end of last year.

To be sure, a couple of biotechs make the grade. Tesaro is up top with neratinib (where it will weigh in against a striving AstraZeneca). And Kite is out to score the biggest new entry among the pioneering CAR-Ts. Both will be looking to make a big change in growing commercialization arms.

The only big 10 player not on the list? GlaxoSmithKline. To be sure, Shingrix is likely to come close to blockbuster status, giving the company more to be pleased with from its vaccines division. But the company manages to consistently disappoint analysts with an unexciting late-stage pipeline.

Here’s a snapshot of the 15 new drugs launching this year that can reasonably expect to hit blockbuster status in 5 years. Just remember, peak sales estimates are consistently disappointing. Sell-side analysts often overlook just how hard payers can fight against new entries with big prices. And right now, who really knows what the Trump administration has in mind for keeping its promise to slash drug prices?

Log-in or subscribe to see the full chart and our analysis on each of the top 15 would-be 2017 blockbuster drugs.

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.